New Jersey State Tax Married Filing Jointly . new jersey provides a standard personal exemption tax deduction of $ 1,000.00 in 2024 per qualifying filer and $ 1,500.00 per qualifying. for a new jersey resident that files their tax return as: Your tax is $0 if your income is. new jersey — married filing jointly tax brackets. Single or married filing separately have seven possible tax brackets. What is the married filing jointly income tax filing. you must use the new jersey tax rate schedules if your new jersey taxable income is $100,000 or more. if you are married or in a civil union on the last day of the tax year, you and your spouse/civil union partner can. use our income tax calculator to estimate how much tax you might pay on your taxable income.

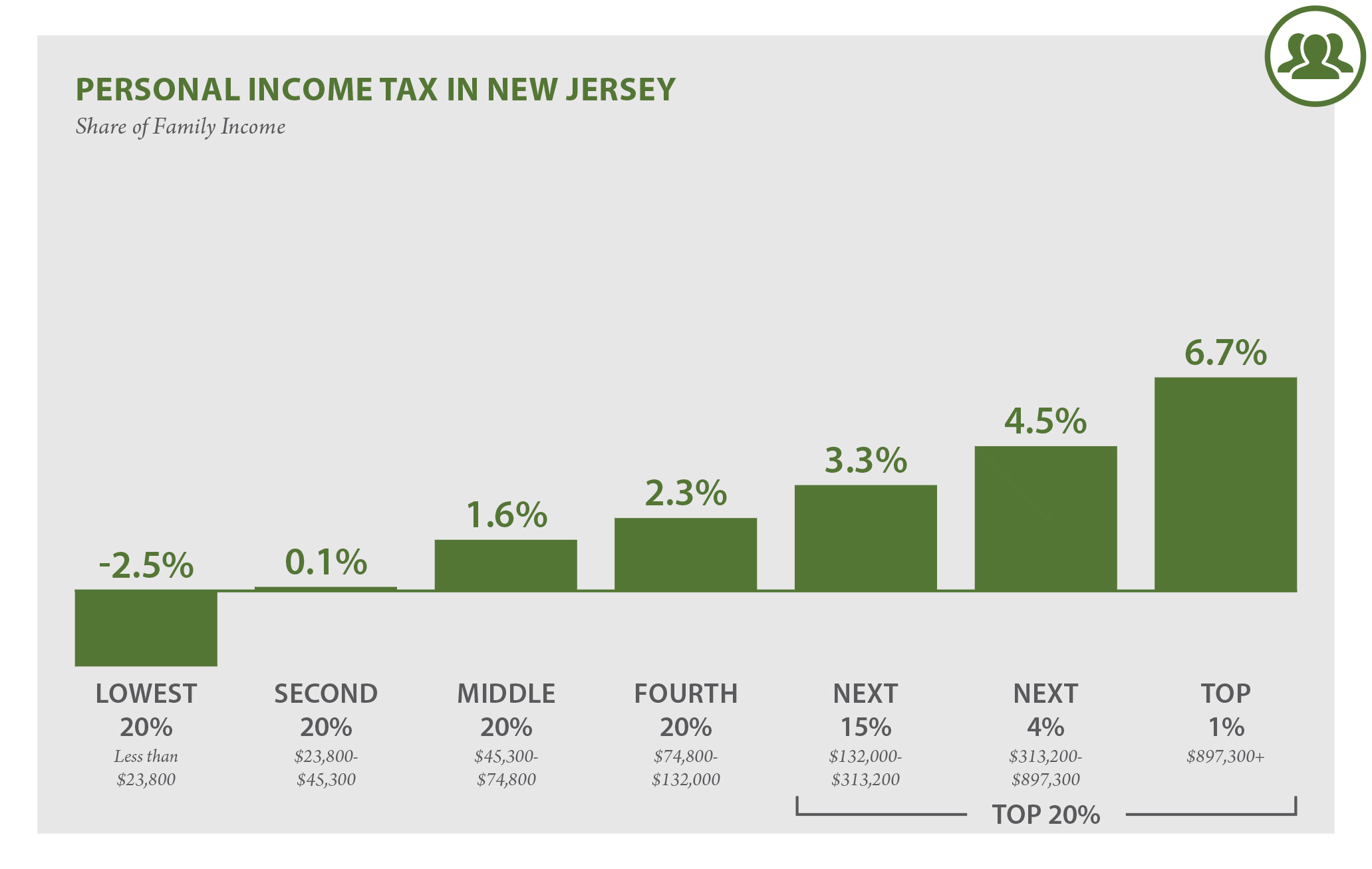

from itep.org

use our income tax calculator to estimate how much tax you might pay on your taxable income. for a new jersey resident that files their tax return as: new jersey — married filing jointly tax brackets. if you are married or in a civil union on the last day of the tax year, you and your spouse/civil union partner can. new jersey provides a standard personal exemption tax deduction of $ 1,000.00 in 2024 per qualifying filer and $ 1,500.00 per qualifying. Your tax is $0 if your income is. Single or married filing separately have seven possible tax brackets. you must use the new jersey tax rate schedules if your new jersey taxable income is $100,000 or more. What is the married filing jointly income tax filing.

New Jersey Who Pays? 6th Edition ITEP

New Jersey State Tax Married Filing Jointly What is the married filing jointly income tax filing. Your tax is $0 if your income is. you must use the new jersey tax rate schedules if your new jersey taxable income is $100,000 or more. Single or married filing separately have seven possible tax brackets. What is the married filing jointly income tax filing. for a new jersey resident that files their tax return as: if you are married or in a civil union on the last day of the tax year, you and your spouse/civil union partner can. new jersey — married filing jointly tax brackets. use our income tax calculator to estimate how much tax you might pay on your taxable income. new jersey provides a standard personal exemption tax deduction of $ 1,000.00 in 2024 per qualifying filer and $ 1,500.00 per qualifying.

From carinaqsandra.pages.dev

Nj State Tax Brackets 2024 Berte Melonie New Jersey State Tax Married Filing Jointly Single or married filing separately have seven possible tax brackets. use our income tax calculator to estimate how much tax you might pay on your taxable income. you must use the new jersey tax rate schedules if your new jersey taxable income is $100,000 or more. new jersey provides a standard personal exemption tax deduction of $. New Jersey State Tax Married Filing Jointly.

From dxomiqetu.blob.core.windows.net

New Jersey State Tax Benefit at Charles Washington blog New Jersey State Tax Married Filing Jointly for a new jersey resident that files their tax return as: new jersey — married filing jointly tax brackets. new jersey provides a standard personal exemption tax deduction of $ 1,000.00 in 2024 per qualifying filer and $ 1,500.00 per qualifying. use our income tax calculator to estimate how much tax you might pay on your. New Jersey State Tax Married Filing Jointly.

From cristiycharmane.pages.dev

New Tax Brackets 2024 Married Jointly And Jointly Jenny Lorinda New Jersey State Tax Married Filing Jointly use our income tax calculator to estimate how much tax you might pay on your taxable income. Your tax is $0 if your income is. for a new jersey resident that files their tax return as: if you are married or in a civil union on the last day of the tax year, you and your spouse/civil. New Jersey State Tax Married Filing Jointly.

From www.youtube.com

W4 for Married filing jointly with dependents. w4 Married filing New Jersey State Tax Married Filing Jointly What is the married filing jointly income tax filing. for a new jersey resident that files their tax return as: Single or married filing separately have seven possible tax brackets. use our income tax calculator to estimate how much tax you might pay on your taxable income. Your tax is $0 if your income is. new jersey. New Jersey State Tax Married Filing Jointly.

From www.taxuni.com

New Jersey State Taxes Guide New Jersey State Tax Married Filing Jointly if you are married or in a civil union on the last day of the tax year, you and your spouse/civil union partner can. new jersey — married filing jointly tax brackets. Single or married filing separately have seven possible tax brackets. you must use the new jersey tax rate schedules if your new jersey taxable income. New Jersey State Tax Married Filing Jointly.

From www.aarp.org

IRS Sets 2024 Tax Brackets with Inflation Adjustments New Jersey State Tax Married Filing Jointly What is the married filing jointly income tax filing. new jersey provides a standard personal exemption tax deduction of $ 1,000.00 in 2024 per qualifying filer and $ 1,500.00 per qualifying. Single or married filing separately have seven possible tax brackets. you must use the new jersey tax rate schedules if your new jersey taxable income is $100,000. New Jersey State Tax Married Filing Jointly.

From bellajackson.pages.dev

Nj State Tax Rates 2025 Bella Jackson New Jersey State Tax Married Filing Jointly use our income tax calculator to estimate how much tax you might pay on your taxable income. What is the married filing jointly income tax filing. Single or married filing separately have seven possible tax brackets. new jersey — married filing jointly tax brackets. if you are married or in a civil union on the last day. New Jersey State Tax Married Filing Jointly.

From dxomiqetu.blob.core.windows.net

New Jersey State Tax Benefit at Charles Washington blog New Jersey State Tax Married Filing Jointly new jersey provides a standard personal exemption tax deduction of $ 1,000.00 in 2024 per qualifying filer and $ 1,500.00 per qualifying. Single or married filing separately have seven possible tax brackets. if you are married or in a civil union on the last day of the tax year, you and your spouse/civil union partner can. you. New Jersey State Tax Married Filing Jointly.

From web.eztaxreturn.com

Easily Track and Manage Your New Jersey State Tax Refund New Jersey State Tax Married Filing Jointly new jersey provides a standard personal exemption tax deduction of $ 1,000.00 in 2024 per qualifying filer and $ 1,500.00 per qualifying. Single or married filing separately have seven possible tax brackets. if you are married or in a civil union on the last day of the tax year, you and your spouse/civil union partner can. new. New Jersey State Tax Married Filing Jointly.

From newjerseynotarypro.com

Navigating Tax Decisions Married Filing Jointly vs. Married Filing New Jersey State Tax Married Filing Jointly use our income tax calculator to estimate how much tax you might pay on your taxable income. new jersey provides a standard personal exemption tax deduction of $ 1,000.00 in 2024 per qualifying filer and $ 1,500.00 per qualifying. Your tax is $0 if your income is. What is the married filing jointly income tax filing. new. New Jersey State Tax Married Filing Jointly.

From www.vrogue.co

How To Fill Out W 4 Form Married Filing Jointly 2023 vrogue.co New Jersey State Tax Married Filing Jointly new jersey — married filing jointly tax brackets. Your tax is $0 if your income is. new jersey provides a standard personal exemption tax deduction of $ 1,000.00 in 2024 per qualifying filer and $ 1,500.00 per qualifying. you must use the new jersey tax rate schedules if your new jersey taxable income is $100,000 or more.. New Jersey State Tax Married Filing Jointly.

From joyanyshelley.pages.dev

Tax Rates 2024 Nj Nedda Viviyan New Jersey State Tax Married Filing Jointly Single or married filing separately have seven possible tax brackets. What is the married filing jointly income tax filing. Your tax is $0 if your income is. new jersey provides a standard personal exemption tax deduction of $ 1,000.00 in 2024 per qualifying filer and $ 1,500.00 per qualifying. you must use the new jersey tax rate schedules. New Jersey State Tax Married Filing Jointly.

From www.taxextension.com

How to File a New Jersey State Tax Extension Filing Info & Forms New Jersey State Tax Married Filing Jointly new jersey — married filing jointly tax brackets. What is the married filing jointly income tax filing. for a new jersey resident that files their tax return as: you must use the new jersey tax rate schedules if your new jersey taxable income is $100,000 or more. if you are married or in a civil union. New Jersey State Tax Married Filing Jointly.

From dolfbrain.weebly.com

2021 nj tax brackets dolfbrain New Jersey State Tax Married Filing Jointly you must use the new jersey tax rate schedules if your new jersey taxable income is $100,000 or more. use our income tax calculator to estimate how much tax you might pay on your taxable income. if you are married or in a civil union on the last day of the tax year, you and your spouse/civil. New Jersey State Tax Married Filing Jointly.

From projectopenletter.com

What Are The Tax Brackets For 2022 Married Filing Jointly Printable New Jersey State Tax Married Filing Jointly Your tax is $0 if your income is. for a new jersey resident that files their tax return as: new jersey provides a standard personal exemption tax deduction of $ 1,000.00 in 2024 per qualifying filer and $ 1,500.00 per qualifying. Single or married filing separately have seven possible tax brackets. use our income tax calculator to. New Jersey State Tax Married Filing Jointly.

From itep.org

New Jersey Who Pays? 6th Edition ITEP New Jersey State Tax Married Filing Jointly What is the married filing jointly income tax filing. Single or married filing separately have seven possible tax brackets. new jersey — married filing jointly tax brackets. you must use the new jersey tax rate schedules if your new jersey taxable income is $100,000 or more. use our income tax calculator to estimate how much tax you. New Jersey State Tax Married Filing Jointly.

From joyanyshelley.pages.dev

Tax Rates 2024 Nj Nedda Viviyan New Jersey State Tax Married Filing Jointly Single or married filing separately have seven possible tax brackets. new jersey provides a standard personal exemption tax deduction of $ 1,000.00 in 2024 per qualifying filer and $ 1,500.00 per qualifying. use our income tax calculator to estimate how much tax you might pay on your taxable income. you must use the new jersey tax rate. New Jersey State Tax Married Filing Jointly.

From www.youtube.com

New Jersey State Taxes Explained Your Comprehensive Guide YouTube New Jersey State Tax Married Filing Jointly Single or married filing separately have seven possible tax brackets. new jersey provides a standard personal exemption tax deduction of $ 1,000.00 in 2024 per qualifying filer and $ 1,500.00 per qualifying. What is the married filing jointly income tax filing. Your tax is $0 if your income is. use our income tax calculator to estimate how much. New Jersey State Tax Married Filing Jointly.